Business Credit Card Road Map

Do you have itch for a new business credit card sign up bonus?

Don’t want to jeopardize your Chase 5/24 status?

Don’t want it to report to your personal credit?

Don’t want a hard inquiry on your personal credit? (AMEX Rule Applies)

Well today is your lucky day!!!

Business Credit Cards are a powerful tool for any business owner. They remove your personal credit from your business and give you amazing rewards and perks for all your travel and cash back needs! It’s important to separate personal credit from our businesses so that our personal scores are not affected by the sometimes very large purchases made in our businesses.

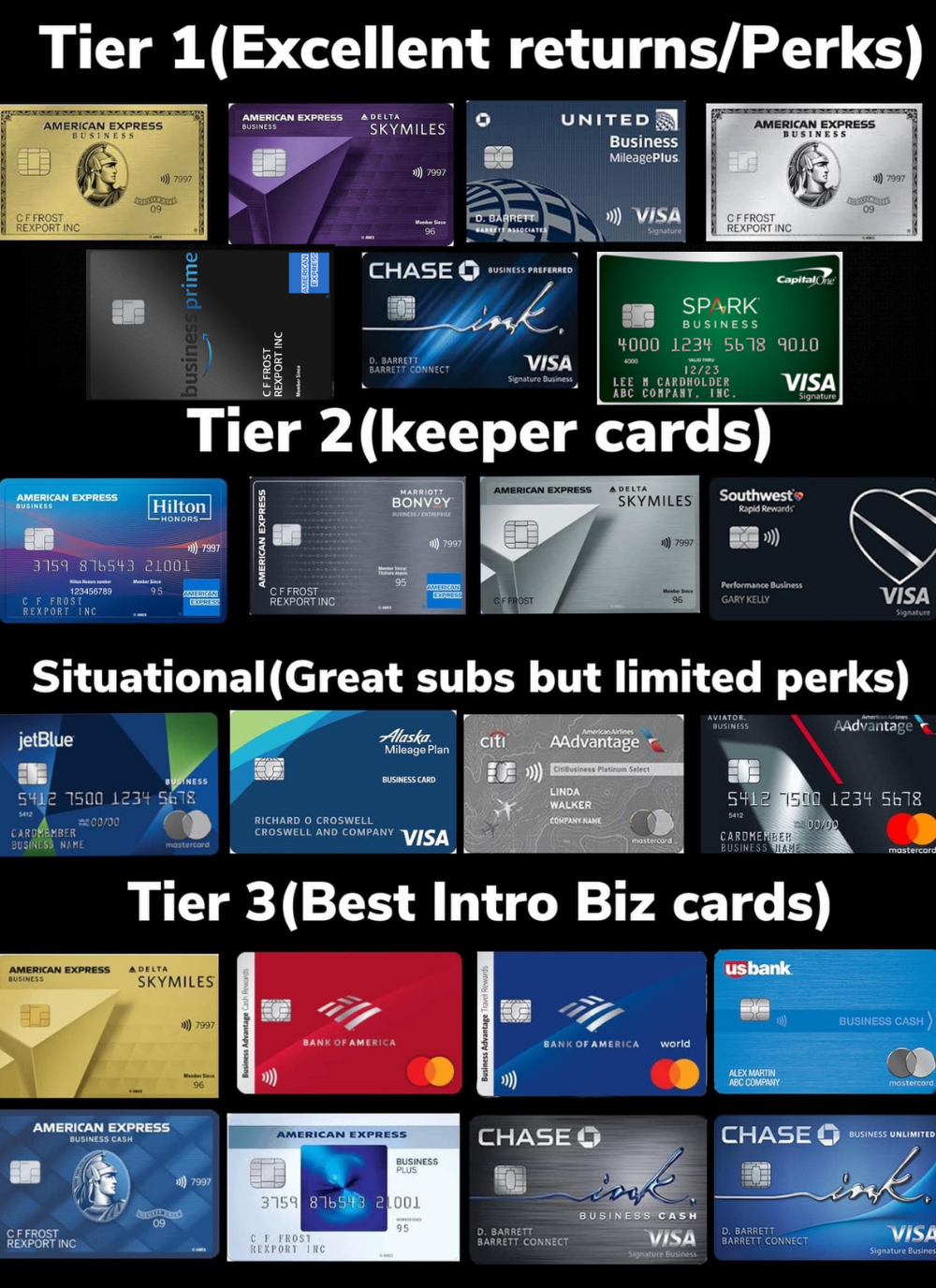

I have put together this chart to help guide you on the business credit card roadmap that you can follow to maximize the bang for your buck on business credit rewards!

It is divided into 4 tiers:

Tier 3

Tier 2.5 (Conditional Cards)

Tier 2

Tier 1

Tier 1:

- AMEX Business Gold

- AMEX Delta Skymiles Reserve Business

- Chase United Business MileagePlus VISA Signature

- AMEX Business Platinum

- AMEX Amazon Business Prime

- Chase Ink Business Preferred

- Capitol One Spark Business

Tier 2:

- AMEX Hilton Honors Business

- AMEX Marriott Bonvoy Business

- AMEX Delta Skymiles Platinum Business

- Chase Southwest Rapid Rewards Performance Business

Tier 2.5 (Situational):

- Barclays JetBlue Business

- Bank of America Alaska Business

- CitiBusiness AAdvantage Platinum Select World Mastercard

- Barclays AAdvantage Aviator Business

Tier 3:

- AMEX Delta Skymiles Gold Business

- Bank of America Business Cash Rewards

- Bank of America Travel Rewards Business

- US Bank Business Cash

- AMEX Blue Business Cash

- AMEX Blue Business Plus

- Chase Ink Business Cash

- Chase Ink Business Unlimited

If you are receiving mail offers from credit card companies, you are essentially pre-approved for the card and you should call in to the bank with your information ready to go for the application. Your chances of being approved with this type of offer are very high!

I have developed a Business Credit Coaching Program that will set you up for success to apply for any Business Credit Card that your heart desires.

In this program you will learn:

- How to Formulate Your Business Properly to Maximize Business Credit Potential

- Essential Services to List Your Company with Before Applying for Business Credit

- The 7 Step Process to Secure Your Business Credit Foundation

- The 3 Tiers of Trade Lines that Show Lenders You Mean Business!

- Critical Steps to Optimize Your Business Credit Score

- Top 10 Business Credit Cards that Reap MASSIVE Rewards and Elite Statuses

To get a full breakdown of the rewards offered with each of these credit cards visit: https://www.uscreditcardguide.com/small-business-credit-cards-en/